Joel Monk

The Business Model:

Ziroom is a large, high quality real estate rental service currently based in 9 locations across China. In 2011, the CEO, Lin Xiong, saw a gap in the market for a high quality apartment rental service, targeting new graduates, young professionals and young families who are not able to afford a place of their own due to the severe price hikes occurring in the Beijing property market. Currently, the housing in Beijing is out of reach for most young people as prices have been increasing by an average of 10.6% year on year (ft.com, 2019) faster than anywhere else in the world, and renting is therefore the best option. The market is currently considered a ‘sellers market’, due to high demand for rooms but few affordable spaces, this left a ‘miss match’ of demand where students and young people were forced into taking whatever was available.

Ziroom’s business model revolves around them renting these unused spaces from ‘lazy’ landlords. They tend to minimise the risk undertaken by opting for longer term rental agreements from the landlords (at least 2 years) (Yu & Mao, 2015, page 10), this is important as it makes them less susceptible risks that occur due to unpredictable changes in the market. Ziroom then renovates the spaces to a high standard by putting in custom made furniture, high end electronic appliances by well known brands and extras such as live plants to make the living spaces feel more premium. Ziroom then splits the spaces off into rooms and rents them out individually for a better, more affordable price. The rooms and decorations are as standardised as possible to reduce implementation and set up costs for Ziroom.

The supplementary and facilitating services that Ziroom offer are one of the things that ultimately differentiates them from the competition, gives them a competitive advantage and supposedly justifies their higher prices whilst adding value for their ‘Ziroomers’. Ziroom’s online facilities make the whole process much easier, allowing for symmetrical information across platforms regarding prices, online rent payments and online contracting, all big benefits for time starved young professionals.

They also currently offer high quality appliances in every room that are replaced every 5 years, a bi-weekly cleaning service, free equipment checks, online bill paying and more. To pay for these services, Ziroom charge tenants 10% of their annual rent as a service fee, which could be considered steep for students and young professionals. Ziroom’s business model is based a lot on gaining the trust of the individuals consumers, one of the main benefits of using Ziroom over traditional online renting is their transparency in terms of costings and resolution of complaints. Ziroom offer 3 promises that differentiate themselves from competitors, they are: a full rent refund if a customer isn’t satisfied and moves out within 30 days. They also promise a cleaning rework if a customer is not satisfied with the cleanliness. Finally they offer an emergency maintenance service which promises a worker to be there within 2 hours. This trust and transparency makes consumers feel safe in their hands and more likely to rent with the company in the future.

The Problem:

This brings me onto the problem that I believe faces current and future Ziroomers, and that is the current high prices that Ziroom charge and possibility of price increases thereafter. The way the market is going in Beijing suggests that rent costs will continue to rise. Ziroom currently increase their rent paid to landlords by 3% each year to keep them interested (Yu & Mao, 2015, page 10), meaning that they will at some point have to increase their tenants rent or service fee to cover these rising overhead costs. Due to the large proportion of Ziroom’s current demographic being young, financially unstable graduates and young families, their sensitivity to price increases would most likely cause them to abandon the brand and rent somewhere else cheaper, thus damaging Ziroom’s profits. There needs to be a way to reduce overhead costs and then pass some of the savings onto the consumer to offer a cheaper price, even if it means allowing customers to sacrifice some of their added benefits.

The Solution – Process Innovation via Internalisation:

Due to their incredibly high maintenance and cleaning costs, I would suggest that Ziroom look to employ process innovation and augment their existing service line by purchasing one of the industrial / commercial cleaning and maintenance companies that they currently regularly hire to manage the cleaning of the rooms. Ziroom currently dedicate 50% of their outgoings to hiring maintenance and cleaning companies to help look after tenants’ equipment (Yu & Mao, 2015, page 23), these outgoings could be drastically reduced in the long run by internalising this service. This could either be done via the acquisition of a separate, existing company, or the mass hiring of dedicated employees. I believe this would help solve problems in a number of areas:

- Reduce overhead costs in the long term, allowing Ziroom to pass some of the savings onto the consumers, thus providing them with better rent prices, keeping them happy.

- Allow for tighter control over the quality of service delivered, as they are owned and operated by Ziroom, they can train them properly and account for less re-dos, again saving money.

- Increase the availability of housekeepers to customers. This was one of the gripes that a customer had in the case study and could help increase the value proposition of the service.

- Allow for a more personalised cleaning experience. If the company was owned and operated by Ziroom, they could offer tailored cleaning packages for different price points as it wouldn’t have to be as standardised as before. Students who want to clean for themselves can have the opportunity to pay less service fee, but receive less benefits from the cleaning staff.

- More opportunity for expansion. Ziroom is planning on expanding the business even further, and a dedicated, internally run cleaning force could make expansion into a new market cheaper and a bit easier, as employing them frees up more capital to be used elsewhere.

How and Why It Works:

The aim is an augmentation or extension of the current existing service line, this uses incremental process innovation to slightly improve the organisational capabilities of Ziroom, allowing them to offer a greater value proposition to their customers and improve the service without changing the original offering (Gallouj & Weinstein, 1997, Oke, 2007). Process innovation is defined by Davenport (2011) as the adoption of a process view of the business with the application of innovation to key processes.

Although the initial acquisition cost of a cleaning service would be high, I believe that due to their current level of spending, Ziroom could save money in the long run. It’s fair to assume that the cost of renting these services will increase over time, so acquisition is a safe way to control these costs more effectively. After the initial hit, Ziroom can reduce the cost of their customers rent slightly, or offer customers a ‘no rise rent’ agreement for the next 3-4 years to keep them locked in at a certain price. With the acquisition, Ziroom can also offer people who want it a ‘reduced’ cleaning service for a lessened service fee at the end of the year which would keep even the most price sensitive customers happy.

Reduced Service Fee – ‘Ziroom Lite’:

Some customers feel like the service fee is a little too steep to be added onto an already above average rent price, so to maximise capacity utilisation, Ziroom could offer the option to pay a reduced service fee but get less of the benefits. For example, instead of bi-weekly cleaning, reduced fee members can receive two monthly visits on a day of their choice for a 5% of rent annual charge. Ziroom Lite members would receive limited entry to the in house gym as well as no free invitations to Ziroom parties, they would instead pay a small fee to attend. By doing this, less people use the facilities on site which means they can be cleaned less frequently by staff as well as adding value to the premium members as the spaces are less crowded. This reduction in people using the cleaning service would free up more housekeepers to pay attention to the customers paying the premium 10% of annual rent service fee, which solves another customer gripe for Ziroom, further adding value to their service.

It’s important to consider the price point at which Ziroom Lite is set as Millennials are known to be a money conscious generation (Forbes.com, 2015). To do this, an email survey will be sent out to all current Ziroom tenants containing the questions shown below as well as one regarding what price they believe to be fair for a reduced service fee. This will be a way to gauge the levels of interest as well as have the best chances of it working due to getting the figure from direct customer feedback. 70% of the companies rated best for customer experience regularly use customer feedback to make improvements to their services (Afshar, 2015), thus showing the importance of listening to your customer base.

After enough people have responded to gain a significant sample, the best price point can be chosen taking into account the responses from customers.

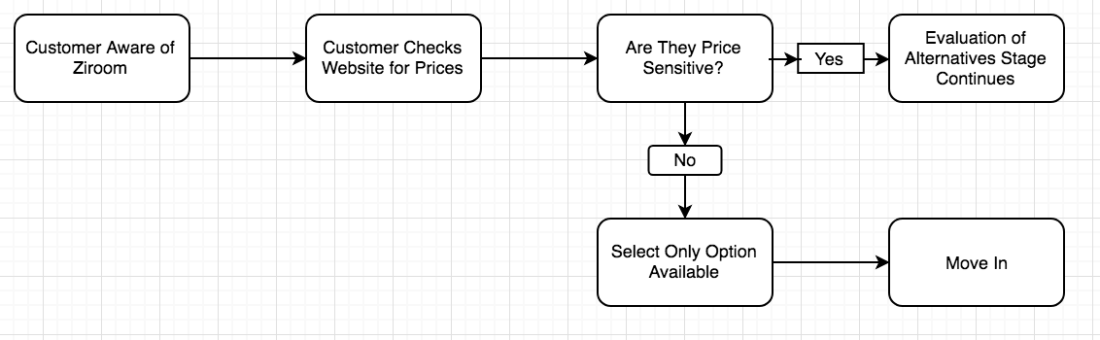

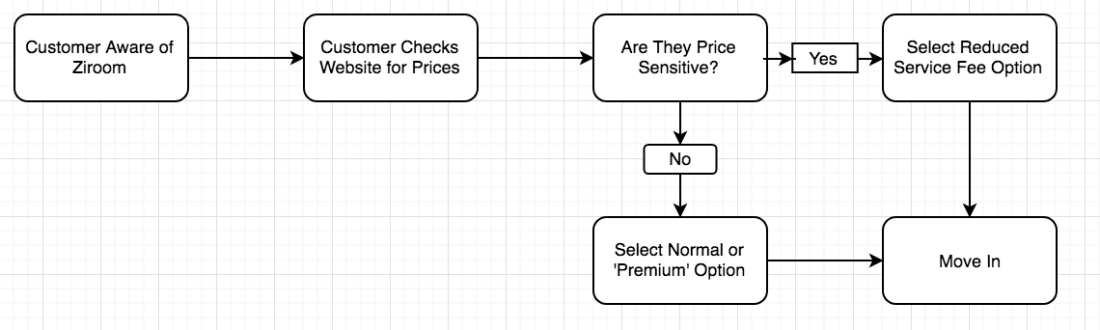

Above is a simplified version of the new and old customer journeys that showcases how this new service offering will help acquire and retain more customers for Ziroom. In the new journey, you can see that by offering a reduced service fee option to more price sensitive consumers, it opens a new pathway to acquisition thus making them more likely to rent with Ziroom rather than continue their evaluation of alternatives stage in the consumer buying process.

Below is a Business Model Canvas showing 9 of the key areas of a business model, but simplified onto one page. It allows one to visualise a new service and how it will work. It shows the value proposition, key activities, customer segments, key partners, cost structuring, key resources, channels and revenue streams (Osterwalder & Pigneur, 2010)

Conclusion:

Ziroom’s current business model is successful and has gained them a large and loyal customer base; however, the way the rental market in China is going suggests that could change in the future. By acquiring a cleaning service and internalising the processes that are currently being handled by external companies, Ziroom could gain tighter control over the quality of service delivery as well as save a significant amount on outgoing expenditure. Ziroom’s poor customer segmentation means they don’t take into account how price sensitive some young consumers really are. By offering no other option than a steep annual service fee, they run the risk of alienating a large proportion of the population, especially with prices expected to rise. By cutting their overhead costs with an acquisition, Ziroom can pass some of the extra savings onto the consumer and offer a new price point for their reduced service in the form of ‘Ziroom Lite’. This will allow for greater retention rates, easier acquisition of customers and more positive customer feedback.

[Word Count: 1855]

References

Ashaf, D. (2015). Customer Experience Statistics. [online] Huffpost.com. Available at: https://bit.ly/2VJVYBy [Accessed 16 May 2019].

Forbes.com. (2019). Millennials: The Money-Conscious Generation?. [online] Available at: https://www.forbes.com/sites/maggiemcgrath/2015/06/22/millennials-the-money-conscious-generation/#6ad575615dc3 [Accessed 16 May 2019].

Ft.com. (2018). China house prices rise signals economic rebound | Financial Times. [online] Available at: https://www.ft.com/content/d055ecf6-600f-11e9-b285-3acd5d43599e [Accessed 16 May 2019].

Oke, A. (2007). Innovation types and innovation management practices in service companies. International Journal of Operations & Production Management, 27(6), pp.564-587.

Osterwalder, A. and Pigneur, Y. (2013). Business model generation. Hoboken, N.J.: Wiley.

Yu, C. and Mao, C. (2016). Ziroom: creating quality rental living. 8-114-311.Tsinghua SEM China Business Case Center

Smart Insights. (2018). Customer experience research statistics 2018. [online] Available at: https://www.smartinsights.com/customer-engagement/customer-engagement-strategy/customer-experience-research-statistics/ [Accessed 16 May 2019].

Faïz Gallouj and Olivier Weinstein, (1997),Innovation in services, Research Policy, 26, (4-5), 537-556